The Privilege of the Non-Indebted

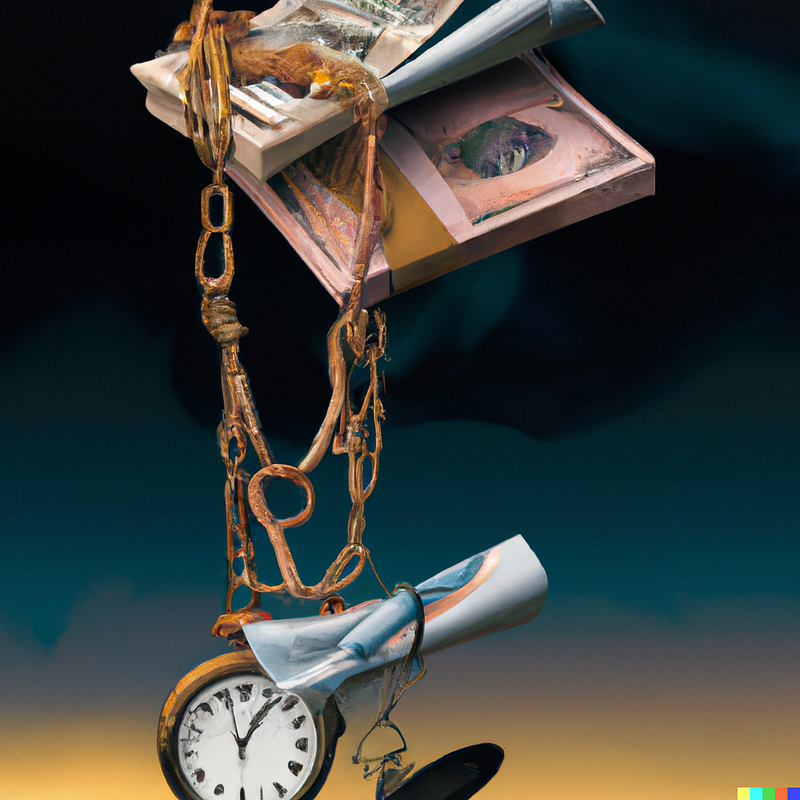

Stack of dollar bills connected to time, balance, and gold using chains. Sarcastic, artistic criticism, artstation trending, low angle shot, digital art, procreate, salvador dali, surrealism. — Yes it was Dall-E generated ;)Being indebted steals away a lot of privilege and opportunities to do something better. Think of it as being chained into an iron rod, and the bigger the debt, the bigger the rod. Sometimes, the chain would grow longer and allow us more movement. But no matter how long, we are in fact, still chained.

Stack of dollar bills connected to time, balance, and gold using chains. Sarcastic, artistic criticism, artstation trending, low angle shot, digital art, procreate, salvador dali, surrealism. — Yes it was Dall-E generated ;)Being indebted steals away a lot of privilege and opportunities to do something better. Think of it as being chained into an iron rod, and the bigger the debt, the bigger the rod. Sometimes, the chain would grow longer and allow us more movement. But no matter how long, we are in fact, still chained.

The opposite side is the life of the non-indebted. They are not chained to any rod, they are free to move in any direction and in any distance. This freedom benefits scales linearly, but the restraint of debt scales exponentially.

People that are in debt are unable to take risks that might yield greater value. They are bound to small risks that ensure they can still pay their debt when it’s due. The inability to take the bigger risk due to the chain of debt limits the individual ability to increase their yield.

People with no debt can take a break from their work to learn something new. They can spend more of their time planting seeds that will yield something in the future instead of spending all their team hustling to get their debt paid. They can take a step back from life, and carefully weigh their options before making significant decisions.

This scales from individuals to startups that loan a lot of money. Now, they are bound to scale up and do whatever it costs to become profitable or go bankrupt. This leads to a lot of mischievous acts being taken to get profits. From dark patterns to data manipulation — being in debt, not only take away the freedom of time, but the freedom of doing something good as well.

The effect is not the same between people and startups. For when a startup goes bust, it evaporated into thin air. But for people to go default on their debt, is a significant thing that will affect them for the rest of their life.

It is a reminder to myself if I am about to put myself into the strangling chain of debt. Do I have enough strength to break free from it? Or will I be eternally chained and be rid of my freedom to decide; not based on the haunting time, nor based on the scale of the risk — but based on the quality of the decision?